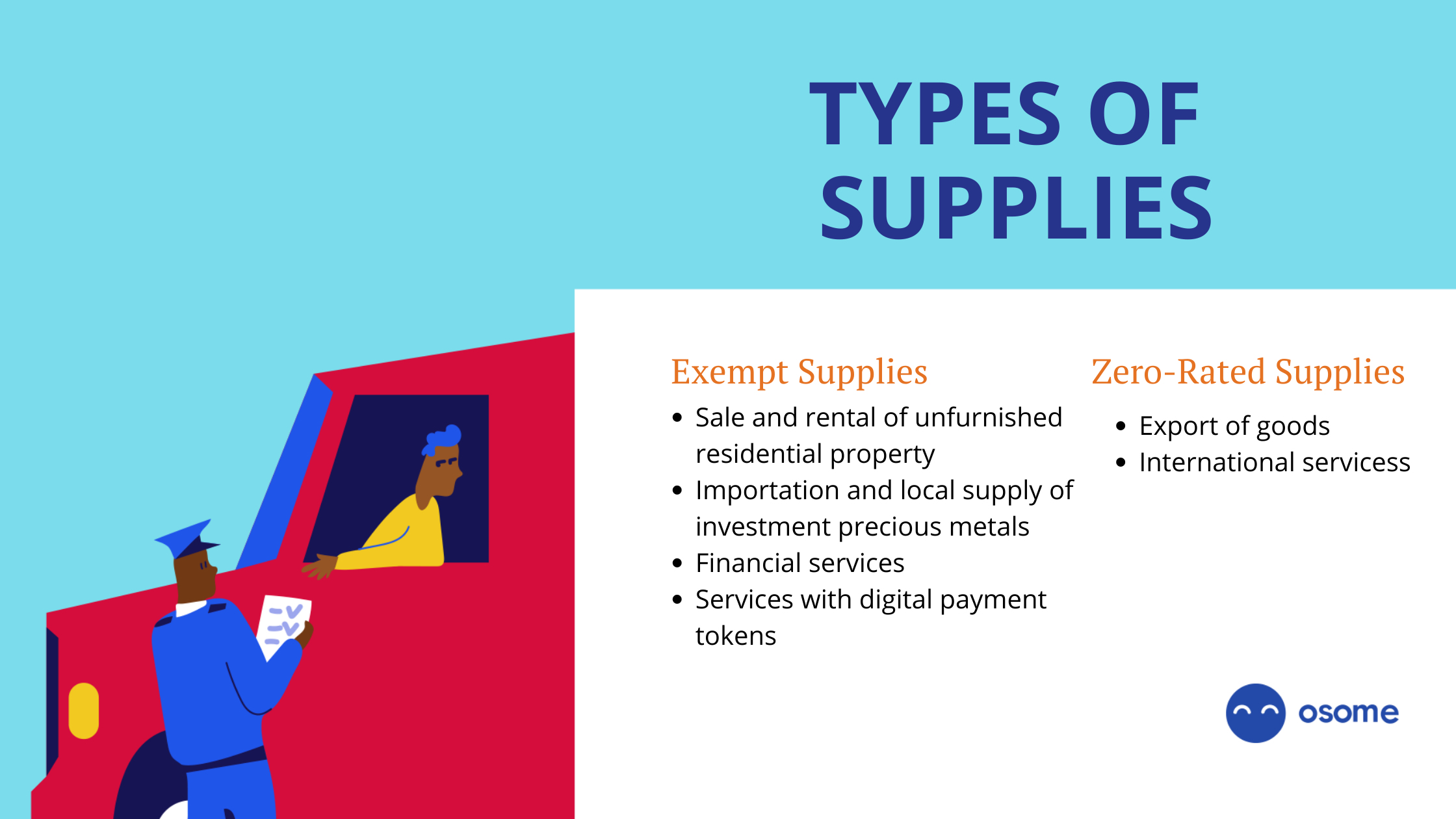

Is Exempt Supplies Taxable . • interest received from banks/bonds/loan stocks; No gst is levied on a supply that is exempt from gst. You'll learn about the details of taxable supplies and the exemptions that may apply to you. The provision of financial services; Supplies that are exempt from gst include: For instance, the provision of most financial services, the sale. Examples of exempt supplies are: Certain goods and services are exempt from the scope of gst; Gst will not be charged on exempt supplies. If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. The supply of digital payment tokens (with effect from 1 jan.

from osome.com

You'll learn about the details of taxable supplies and the exemptions that may apply to you. “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. No gst is levied on a supply that is exempt from gst. The supply of digital payment tokens (with effect from 1 jan. The provision of financial services; If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Gst will not be charged on exempt supplies. Certain goods and services are exempt from the scope of gst; • interest received from banks/bonds/loan stocks; For instance, the provision of most financial services, the sale.

Goods and Services Tax (GST) in Singapore What Is It?

Is Exempt Supplies Taxable For instance, the provision of most financial services, the sale. “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. The provision of financial services; Examples of exempt supplies are: • interest received from banks/bonds/loan stocks; The supply of digital payment tokens (with effect from 1 jan. Supplies that are exempt from gst include: You'll learn about the details of taxable supplies and the exemptions that may apply to you. No gst is levied on a supply that is exempt from gst. Certain goods and services are exempt from the scope of gst; For instance, the provision of most financial services, the sale. Gst will not be charged on exempt supplies. If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to.

From saral.pro

GST exempt supply List of goods and services exempted Is Exempt Supplies Taxable No gst is levied on a supply that is exempt from gst. Certain goods and services are exempt from the scope of gst; Supplies that are exempt from gst include: “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. You'll learn about the details of taxable. Is Exempt Supplies Taxable.

From www.studocu.com

Exempt Supplies VAT EXEMPT SUPPLIES s FINANCIAL SERVICES Interest Is Exempt Supplies Taxable For instance, the provision of most financial services, the sale. If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Supplies that are exempt from gst include: Examples of exempt supplies are: • interest received from banks/bonds/loan stocks; The supply of digital payment tokens. Is Exempt Supplies Taxable.

From www.youtube.com

Difference between Zerorated & Exempt VAT Supplies in UAE YouTube Is Exempt Supplies Taxable Gst will not be charged on exempt supplies. “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. For instance, the provision of most financial services, the sale. Supplies that are exempt from gst include: Certain goods and services are exempt from the scope of gst; The. Is Exempt Supplies Taxable.

From www.detailsolicitors.com

THE IMPACT OF THE VALUE ADDED TAX (MODIFICATION ORDER) 2020 ON Is Exempt Supplies Taxable Examples of exempt supplies are: If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Gst will not be charged on exempt supplies. Supplies that are exempt from gst include: • interest received from banks/bonds/loan stocks; You'll learn about the details of taxable supplies. Is Exempt Supplies Taxable.

From osome.com

Goods and Services Tax (GST) in Singapore What Is It? Is Exempt Supplies Taxable Supplies that are exempt from gst include: No gst is levied on a supply that is exempt from gst. If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. For instance, the provision of most financial services, the sale. “exempt input tax” means input. Is Exempt Supplies Taxable.

From www.youtube.com

Taxation Difference Between Zero Rated and Exempt Supplies YouTube Is Exempt Supplies Taxable You'll learn about the details of taxable supplies and the exemptions that may apply to you. No gst is levied on a supply that is exempt from gst. Supplies that are exempt from gst include: The supply of digital payment tokens (with effect from 1 jan. Certain goods and services are exempt from the scope of gst; • interest received. Is Exempt Supplies Taxable.

From shahdoshi.com

Exempt Supply Under GST Regime Shah & Doshi Chartered Accountants Is Exempt Supplies Taxable If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Supplies that are exempt from gst include: The provision of financial services; You'll learn about the details of taxable supplies and the exemptions that may apply to you. Examples of exempt supplies are: The. Is Exempt Supplies Taxable.

From retailerpsolutions.blogspot.com

Guidance on ZeroRated and exempt supplies Is Exempt Supplies Taxable If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Supplies that are exempt from gst include: You'll learn about the details of taxable supplies and the exemptions that may apply to you. • interest received from banks/bonds/loan stocks; Gst will not be charged. Is Exempt Supplies Taxable.

From slideplayer.com

Input TAX CREDIT GST Conclave III Hosted by ppt download Is Exempt Supplies Taxable “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. Gst will not be charged on exempt supplies. Certain goods and services are exempt from the scope of gst; No gst is levied on a supply that is exempt from gst. If you are registered for gst,. Is Exempt Supplies Taxable.

From www.youtube.com

Difference between Taxable, Exempted, Nil Rate, Zero Rate & Non Taxable Is Exempt Supplies Taxable No gst is levied on a supply that is exempt from gst. “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. Gst will not be charged on exempt supplies. You'll learn about the details of taxable supplies and the exemptions that may apply to you. The. Is Exempt Supplies Taxable.

From www.slideserve.com

PPT More Advanced VAT Partial Exemption Ian M Harris Leicester City Is Exempt Supplies Taxable Supplies that are exempt from gst include: No gst is levied on a supply that is exempt from gst. The supply of digital payment tokens (with effect from 1 jan. Examples of exempt supplies are: “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. You'll learn. Is Exempt Supplies Taxable.

From medium.com

VAT in UAE What are the zerorated, exempt supplies? by Dubai Is Exempt Supplies Taxable Supplies that are exempt from gst include: Certain goods and services are exempt from the scope of gst; Examples of exempt supplies are: The provision of financial services; If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. No gst is levied on a. Is Exempt Supplies Taxable.

From www.slideserve.com

PPT Accounting for HST Effective July 1, 2010 PowerPoint Presentation Is Exempt Supplies Taxable If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Examples of exempt supplies are: Supplies that are exempt from gst include: No gst is levied on a supply that is exempt from gst. The supply of digital payment tokens (with effect from 1. Is Exempt Supplies Taxable.

From superca.in

List of Goods and Services Exemptions under GST Act SuperCA Is Exempt Supplies Taxable No gst is levied on a supply that is exempt from gst. Gst will not be charged on exempt supplies. For instance, the provision of most financial services, the sale. Examples of exempt supplies are: “exempt input tax” means input tax, or a proportion of input tax, which is attributable to exempt supplies in accordance with the method. You'll learn. Is Exempt Supplies Taxable.

From margcompusoft.com

GST Exemption Exempt Supply and Other Details Marg ERP Blog Is Exempt Supplies Taxable The supply of digital payment tokens (with effect from 1 jan. For instance, the provision of most financial services, the sale. You'll learn about the details of taxable supplies and the exemptions that may apply to you. If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that. Is Exempt Supplies Taxable.

From www.reachaccountant.com

Exempt Supply Invoice Reachaccountant Is Exempt Supplies Taxable You'll learn about the details of taxable supplies and the exemptions that may apply to you. Examples of exempt supplies are: Supplies that are exempt from gst include: For instance, the provision of most financial services, the sale. If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies. Is Exempt Supplies Taxable.

From www.slideserve.com

PPT VAT value added tax PowerPoint Presentation, free download ID Is Exempt Supplies Taxable • interest received from banks/bonds/loan stocks; Certain goods and services are exempt from the scope of gst; You'll learn about the details of taxable supplies and the exemptions that may apply to you. The supply of digital payment tokens (with effect from 1 jan. No gst is levied on a supply that is exempt from gst. The provision of financial. Is Exempt Supplies Taxable.

From www.youtube.com

Difference between Nil rated and zero rated supplies, nontaxable Is Exempt Supplies Taxable If you are registered for gst, you must charge gst on all taxable supplies at the prevailing gst rate, except for supplies that are subject to. Certain goods and services are exempt from the scope of gst; No gst is levied on a supply that is exempt from gst. For instance, the provision of most financial services, the sale. “exempt. Is Exempt Supplies Taxable.